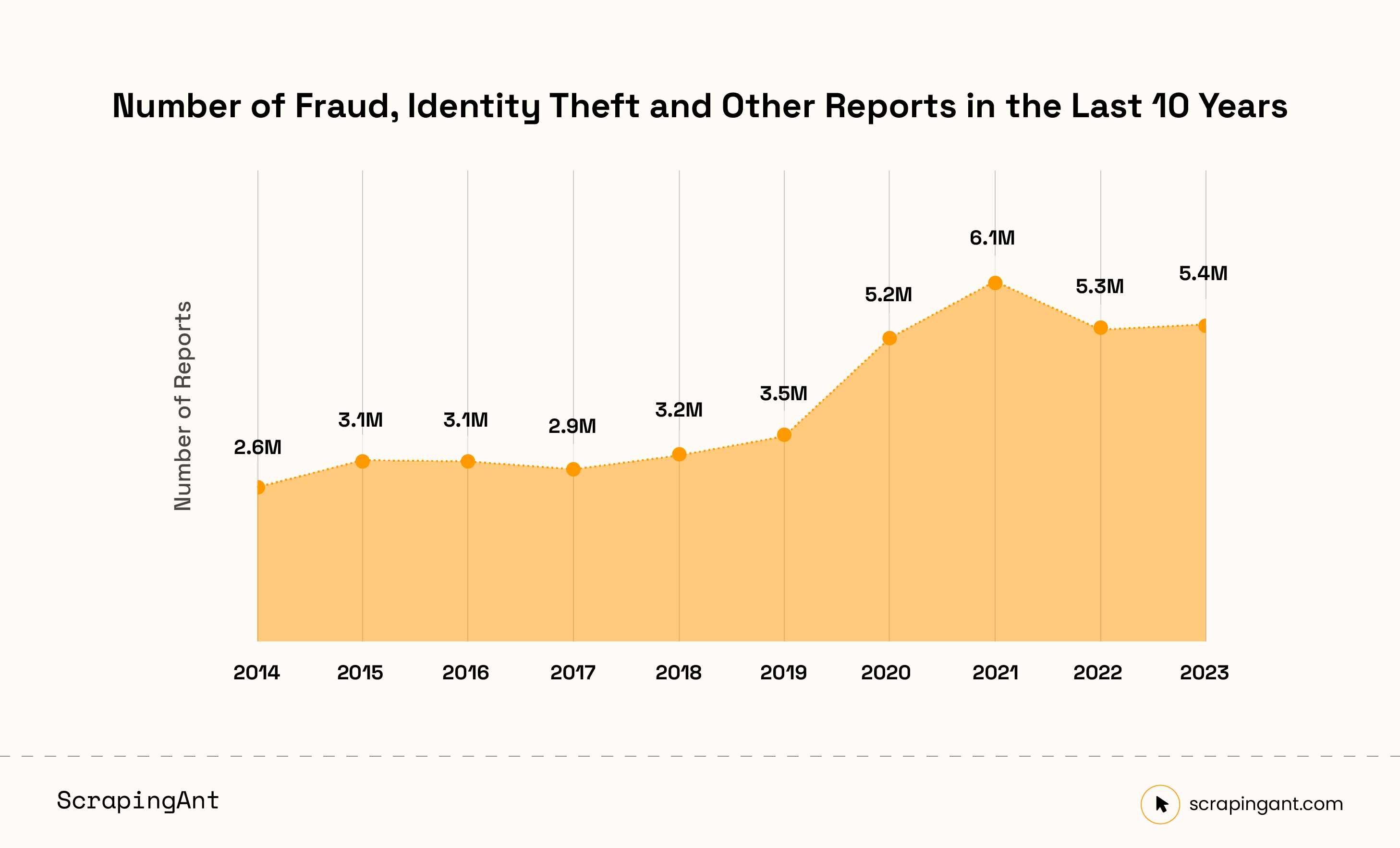

Identity theft and fraud are escalating concerns for millions of Americans. In 2023, the Federal Trade Commission (FTC) received nearly 5.4 million complaints related to these crimes, which translates to 14,773 daily reports. The financial impact is equally alarming, with losses from fraud exceeding $10 billion last year.

Our study examines identity theft and fraud in America for 2024, utilizing the latest data from the Federal Trade Commission (FTC). We analyzed the prevalence of these incidents, looking at factors such as the number of reports per capita and total financial losses. We also examined the types of fraud and identity theft reported, including credit card fraud, imposter scams, and issues with credit bureaus.

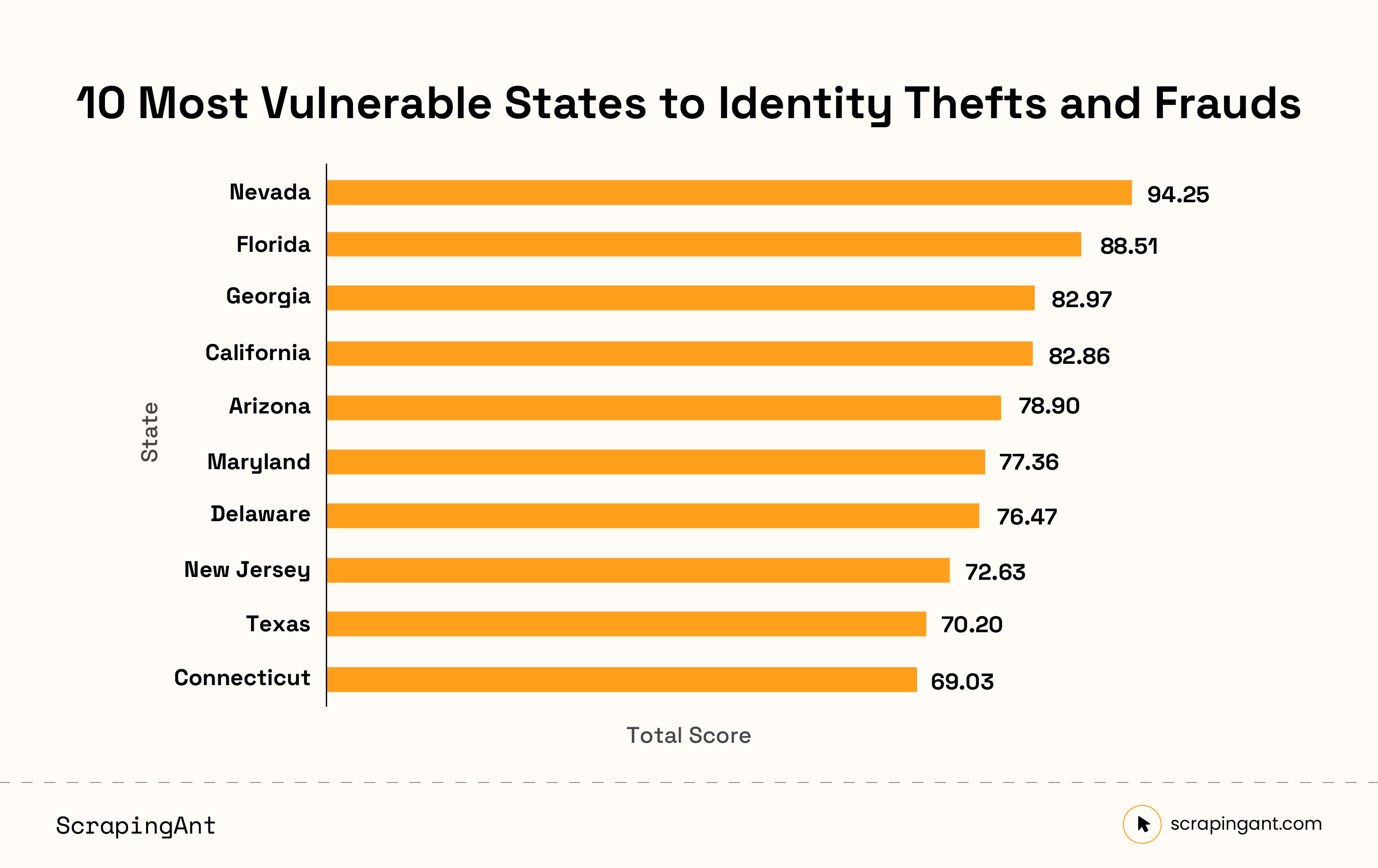

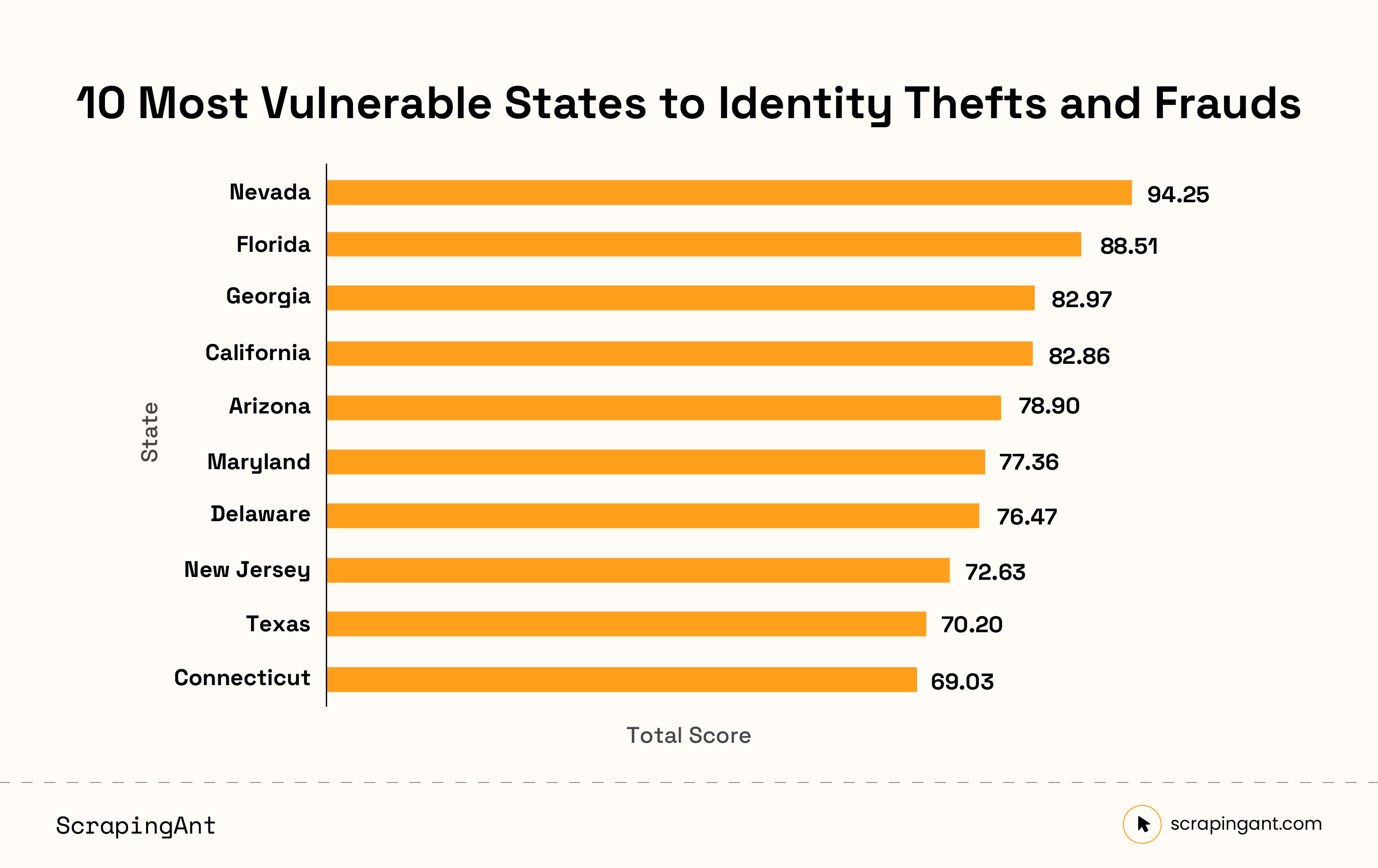

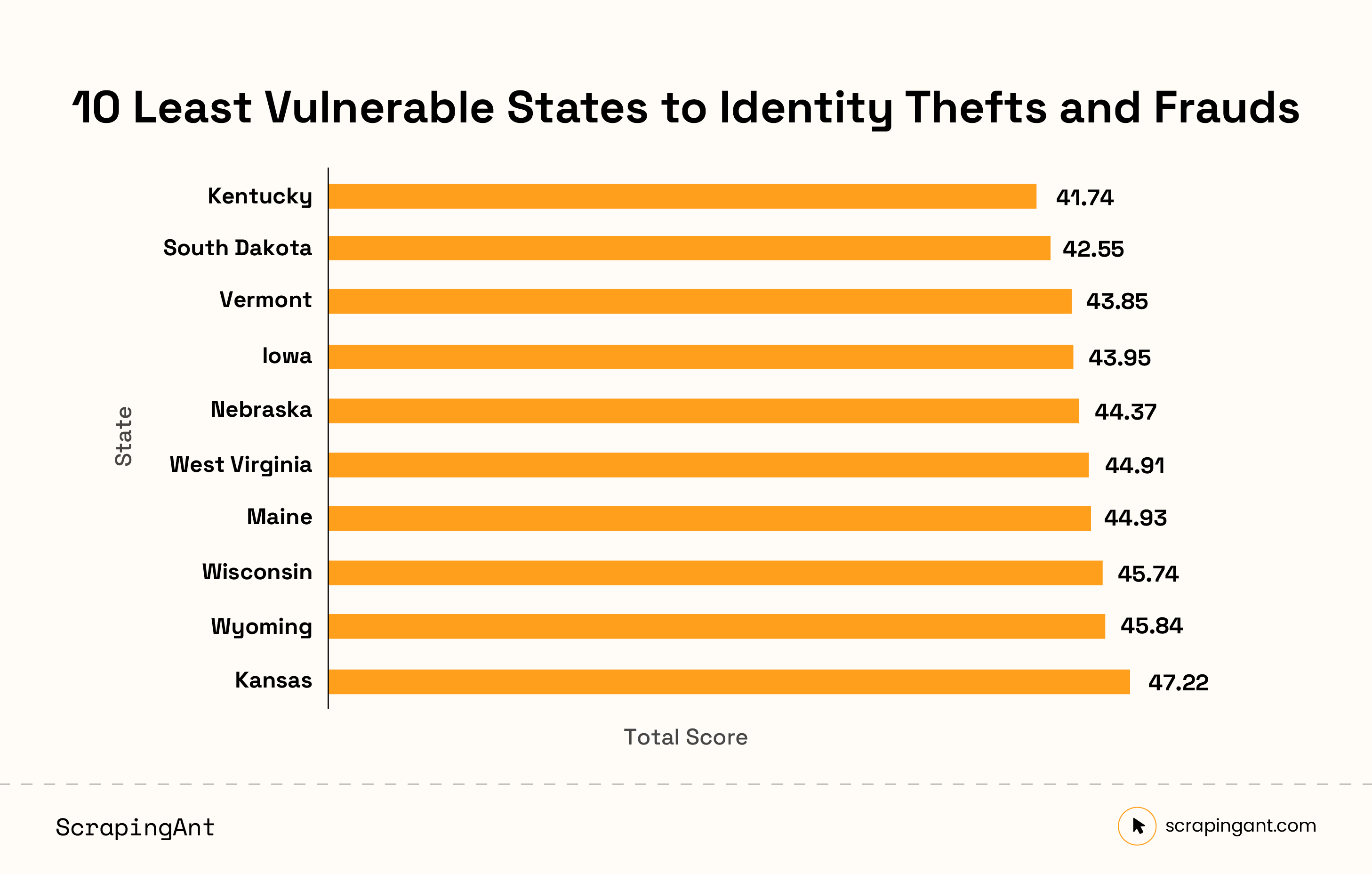

From this comprehensive data, we identified key findings and ranked the states based on their vulnerability to identity theft and fraud. Nevada, Florida, and Georgia emerged as the most vulnerable states, with high numbers of reports and significant financial losses. Conversely, Kentucky, South Dakota, and Vermont were identified as the least vulnerable.

Our goal is to highlight the states most at risk and raise awareness about the growing problem of identity theft and fraud in the United States.

Key Findings

- 5.4 Million Complaints in 2023: Almost 5.4 million identity theft and fraud complaints were reported in 2023, averaging 14,773 complaints daily.

- Top Three Most Vulnerable States: Nevada, Florida, and Georgia are the most vulnerable states to identity theft and fraud.

- Top Three Least Vulnerable States: Kentucky, South Dakota, and Vermont are the least vulnerable states to identity theft and fraud.

- Significant Increase Over a Decade: Identity theft and fraud reports have increased by 51.39% over the past 10 years (2014 to 2023).

- $10 Billion Lost in Fraud Reports: Of the 2.6 million fraud reports in 2023, 27% reported a total loss exceeding $10 billion.

Identity Theft and Fraud Statistics, 2024

5.4 Million Identity Theft and Fraud Complaints Reported in 2023

In 2023, almost 5.4 million identity theft, fraud, and other consumer complaints were reported. This means 14,773 complaints are reported every day in America for identity theft and fraud activities.

1,610 People Affected per 100,000 Residents

At least 1,610 people per 100,000 residents in America are affected by identity theft or fraud incidents. This highlights the widespread impact of these crimes.

51.39% Increase in Reports Over 10 Years

The number of identity theft and fraud reports has increased by 51.39% over the last 10 years, from 2014 to 2023. This significant rise shows the growing prevalence of these crimes.

Top Three Reported Categories

Of all the complaints, Identity Theft, Imposter Scams, and Credit Bureaus, Information Furnishers, and Report Users were the top three reported categories. They accounted for 19.23%, 15.84%, and 13.20% of the complaints, respectively.

Breakdown of Report Types

- Fraud Cases: 47.6% of all reports were fraud cases, including Imposter Scams, Online Shopping and Negative Reviews, Prizes, Sweepstakes, and Lotteries.

- Identity Thefts: 19.23% of all reports were identity thefts, including Credit Card, Other Identity Theft, Loan or Lease, and Bank Account fraud.

- Other Categories: 33.6% of all reports fell into other categories, such as Credit Bureaus, Information Furnishers and Report Users, Banks and Lenders, Auto Related issues, and Debt Collection.

$10 Billion Lost in Fraud Reports

Of the 2.6 million fraud reports, 27% reported a total loss of over $10 billion. This underscores the substantial financial impact of fraud on consumers.

Number of Reports and Amount Lost by Contact Method

| Contact Method | Number of Reports | Total $ Lost | Median $ Lost |

|---|---|---|---|

| Social Media | 181,396 | $1,486M | $341 |

| Other | 167,476 | $1,246M | $625 |

| Phone call | 297,765 | $850M | $1,480 |

| Website or Apps | 193,659 | $894M | $223 |

| 358,428 | $430M | $575 | |

| Text | 230,407 | $372M | $1,000 |

| Online Ad or Pop-up | 43,741 | $224M | $168 |

| 42,235 | $81M | $799 |

Most Vulnerable States to Identity Theft and Fraud (Map)

Most to Least Affected States by ID Theft and Fraud (Table)

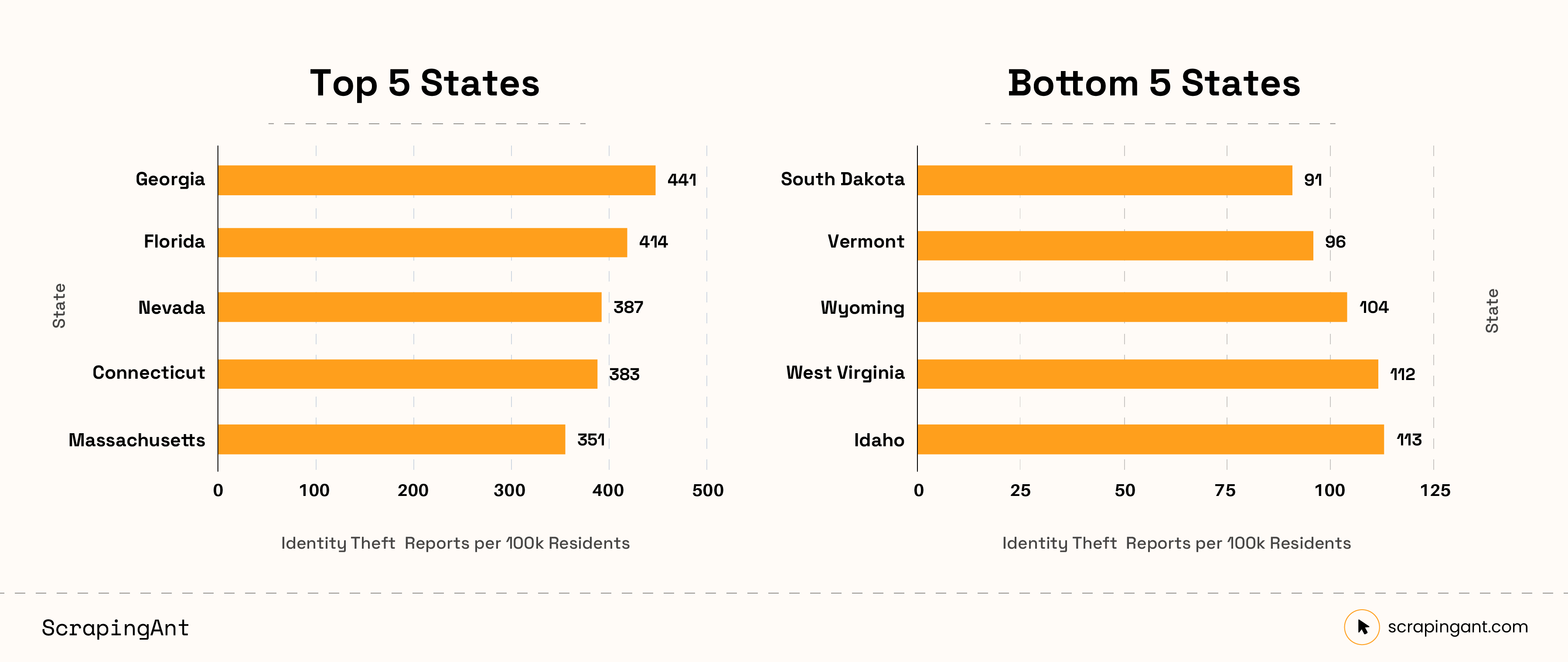

Most and Least Vulnerable 5 States to ID Theft

Most Vulnerable: Georgia is the most vulnerable state to identity theft with 441 identity theft reports per 100,000 residents, totaling 48,606 reports.

Least Vulnerable: South Dakota is the least vulnerable state to identity theft with 91 reports per 100,000 residents, totaling 833 reports.

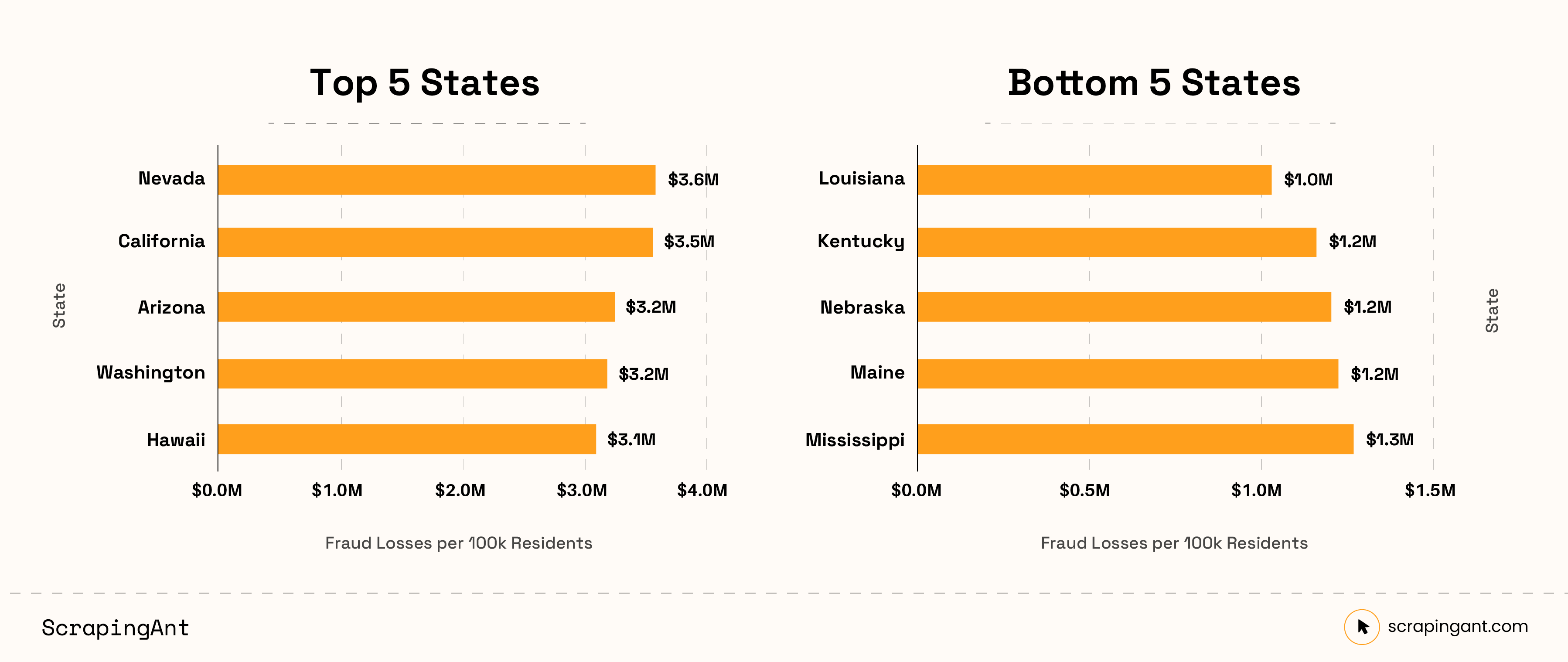

States with Highest and Lowest Fraud Losses

Highest Fraud Losses: Nevada tops the list with a staggering $3.6 million in fraud losses per 100,000 residents, totaling $113.6 million in total fraud losses.

Lowest Fraud Losses: Louisiana has the lowest per capita fraud losses at $1.0 million, with total losses of $46.9 million.

10 Most Vulnerable States to Identity Thefts and Frauds

#1. Nevada:

Score: 94.25 out of 100

Nevada is the most vulnerable state to identity theft and fraud in 2024. The state faces significant financial losses and a high rate of incidents. Here are the key findings:

- Fraud Losses per 100,000 Residents: Nevada experiences $3.56 million in fraud losses per 100,000 residents. This is the highest in the nation.

- Total Fraud Losses: The total reported fraud losses amount to approximately $113.6 million.

- Identity Theft Reports per 100,000 Residents: There are 387 identity theft reports for every 100,000 residents. This shows a widespread issue.

- Fraud and Other Reports per 100,000 Residents: The state sees 1,466 fraud and other related reports per 100,000 residents. This number is very high.

These statistics show the critical need for better measures to protect personal information in Nevada. The state's high vulnerability score means residents and authorities must stay vigilant and proactive in fighting these crimes.

#2. Florida:

Score: 88.51 out of 100

Florida ranks as the second most vulnerable state to identity theft and fraud in 2024. The state faces significant financial losses and numerous reports of identity theft and fraud. Here are the key findings:

- Fraud Losses per 100,000 Residents: Florida experiences $2.80 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $632.2 million.

- Identity Theft Reports per 100,000 Residents: Florida has 414 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,475 fraud and other related reports per 100,000 residents

These figures highlight the severity of identity theft and fraud in Florida. Both residents and authorities need to take proactive steps to safeguard personal information and combat these crimes.

#3. Georgia:

Score: 82.97 out of 100

Georgia ranks as the third most vulnerable state to identity theft and fraud in 2024. The state sees a high number of identity theft and fraud reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Georgia experiences $2.12 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $234.3 million.

- Identity Theft Reports per 100,000 Residents: Georgia has 441 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,507 fraud and other related reports per 100,000 residents.

These numbers demonstrate the significant challenges Georgia faces with identity theft and fraud. It's crucial for residents and authorities to remain vigilant and take preventive measures to protect personal information and reduce these crimes.

#4. California:

Score: 82.86 out of 100

California is the fourth most vulnerable state to identity theft and fraud in 2024. The state suffers from high fraud losses and a large number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: California experiences $3.54 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $1.38 billion.

- Identity Theft Reports per 100,000 Residents: California has 308 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,040 fraud and other related reports per 100,000 residents.

#5. Arizona:

Score: 78.90 out of 100

Arizona is the fifth most vulnerable state to identity theft and fraud in 2024. The state experiences high financial losses and a significant number of fraud reports. Here are the key findings

- Fraud Losses per 100,000 Residents: Arizona experiences $3.23 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $239.8 million.

- Identity Theft Reports per 100,000 Residents: Arizona has 249 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,158 fraud and other related reports per 100,000 residents.

#6. Maryland:

Score: 77.36 out of 100

Maryland is the sixth most vulnerable state to identity theft and fraud in 2024. The state faces considerable financial losses and numerous fraud reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Maryland experiences $2.66 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $164.3 million.

- Identity Theft Reports per 100,000 Residents: Maryland has 297 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,365 fraud and other related reports per 100,000 residents.

#7. Delaware:

Score: 76.47 out of 100

Delaware ranks as the seventh most vulnerable state to identity theft and fraud in 2024. The state has a high number of reports and significant financial losses. Here are the key findings:

- Fraud Losses per 100,000 Residents: Delaware experiences $2.16 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $22.3 million.

- Identity Theft Reports per 100,000 Residents: Delaware has 341 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,428 fraud and other related reports per 100,000 residents.

#8. New Jersey:

Score: 72.63 out of 100

New Jersey ranks as the eighth most vulnerable state to identity theft and fraud in 2024. The state faces considerable financial losses and numerous reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: New Jersey experiences $2.71 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $251.7 million.

- Identity Theft Reports per 100,000 Residents: New Jersey has 281 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,098 fraud and other related reports per 100,000 residents.

#9. Texas:

Score: 70.20 out of 100

Texas is the ninth most vulnerable state to identity theft and fraud in 2024. The state experiences high financial losses and a substantial number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Texas experiences $2.09 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $636.4 million.

- Identity Theft Reports per 100,000 Residents: Texas has 331 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 1,075 fraud and other related reports per 100,000 residents

#10. Connecticut:

Score: 69.03 out of 100

Connecticut ranks as the tenth most vulnerable state to identity theft and fraud in 2024. The state faces notable financial losses and a significant number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Connecticut experiences $1.95 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $70.6 million.

- Identity Theft Reports per 100,000 Residents: Connecticut has 383 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 937 fraud and other related reports per 100,000 residents.

10 Least Vulnerable States to Identity Thefts and Frauds

#50. Kentucky:

Score: 41.74 out of 100

Kentucky ranks as the least vulnerable state to identity theft and fraud in 2024. The state experiences relatively low financial losses and fewer reports compared to others. Here are the key findings:

- Fraud Losses per 100,000 Residents: Kentucky experiences $1.2 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $52.4 million.

- Identity Theft Reports per 100,000 Residents: Kentucky has 118 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 741 fraud and other related reports per 100,000 residents.

These figures indicate that Kentucky has relatively lower instances of identity theft and fraud. Residents and authorities can focus on maintaining and improving current preventive measures to keep these numbers low.

#49. South Dakota:

Score: 42.55 out of 100

South Dakota is the second least vulnerable state to identity theft and fraud in 2024. The state reports low financial losses and fewer incidents. Here are the key findings:

- Fraud Losses per 100,000 Residents: South Dakota experiences $1.4 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $12.8 million.

- Identity Theft Reports per 100,000 Residents: South Dakota has 91 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 564 fraud and other related reports per 100,000 residents.

#48. Vermont:

Score: 43.85 out of 100

Vermont ranks as the third least vulnerable state to identity theft and fraud in 2024. The state experiences low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Vermont experiences $1.4 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $8.8 million.

- Identity Theft Reports per 100,000 Residents: Vermont has 96 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 821 fraud and other related reports per 100,000 residents.

#47. Iowa:

Score: 43.95 out of 100

Iowa ranks as the fourth least vulnerable state to identity theft and fraud in 2024. The state experiences relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Iowa experiences $1.3 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $42.6 million.

- Identity Theft Reports per 100,000 Residents: Iowa has 139 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 613 fraud and other related reports per 100,000 residents.

#46. Nebraska:

Score: 44.37 out of 100

Nebraska is the fifth least vulnerable state to identity theft and fraud in 2024. The state has relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Nebraska experiences $1.2 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $23.8 million.

- Identity Theft Reports per 100,000 Residents: Nebraska has 135 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 758 fraud and other related reports per 100,000 residents.

#45. West Virginia:

Score: 44.91 out of 100

West Virginia ranks as the sixth least vulnerable state to identity theft and fraud in 2024. The state experiences relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: West Virginia experiences $1.3 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $23.3 million.

- Identity Theft Reports per 100,000 Residents: West Virginia has 112 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 775 fraud and other related reports per 100,000 residents.

#44. Maine:

Score: 44.93 out of 100

Maine is the seventh least vulnerable state to identity theft and fraud in 2024. The state experiences low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Maine experiences $1.2 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $17.1 million.

- Identity Theft Reports per 100,000 Residents: Maine has 123 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 795 fraud and other related reports per 100,000 residents.

#43. Wisconsin:

Score: 45.74 out of 100

Wisconsin ranks as the eighth least vulnerable state to identity theft and fraud in 2024. The state has relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Wisconsin experiences $1.3 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $75.9 million.

- Identity Theft Reports per 100,000 Residents: Wisconsin has 140 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 780 fraud and other related reports per 100,000 residents.

#42. Wyoming:

Score: 45.84 out of 100

Wyoming ranks as the ninth least vulnerable state to identity theft and fraud in 2024. The state experiences relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Wyoming experiences $1.3 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $7.7 million.

- Identity Theft Reports per 100,000 Residents: Wyoming has 104 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 773 fraud and other related reports per 100,000 residents.

#41. Kansas:

Score: 47.22 out of 100

Kansas ranks as the tenth least vulnerable state to identity theft and fraud in 2024. The state experiences relatively low financial losses and a moderate number of reports. Here are the key findings:

- Fraud Losses per 100,000 Residents: Kansas experiences $1.4 million in fraud losses per 100,000 residents.

- Total Fraud Losses: The total reported fraud losses amount to approximately $40.4 million.

- Identity Theft Reports per 100,000 Residents: Kansas has 150 identity theft reports for every 100,000 residents.

- Fraud and Other Reports per 100,000 Residents: The state records 750 fraud and other related reports per 100,000 residents.

How Do Identity Thieves Steal Our Information?

Identity thieves use various techniques to steal personal information. Here are the most common methods:

Phishing

Thieves send fake emails or texts that appear to be from legitimate sources to steal login credentials and other sensitive information.

Social Engineering

Thieves manipulate people into divulging confidential information by impersonating trusted individuals or authority figures.

Data Breaches

Hackers infiltrate databases of companies or organizations to access large amounts of personal information.

Malware and Spyware

Malicious software infects devices to capture sensitive data like passwords and account details.

Skimming

Devices attached to ATMs or point-of-sale terminals capture credit or debit card information during transactions.

Public Wi-Fi Networks

Thieves intercept data transmitted over unsecured public Wi-Fi networks to steal personal information.

Dumpster Diving

Thieves search through trash for discarded documents containing personal information.

Mail Theft

Thieves intercept mail looking for bank statements, utility bills, and other documents with sensitive information.

SIM Swapping

Thieves trick mobile carriers into transferring a victim's phone number to a SIM card they control to intercept text messages and calls.

Shoulder Surfing

Thieves observe people as they enter sensitive information, such as PINs or passwords.

Tips to Prevent Identity Theft and Frauds

- Use Strong Passwords: Create complex passwords with a mix of letters, numbers, and symbols. Avoid using easily guessable information like birthdays or common words.

- Enable Two-Factor Authentication: Add an extra layer of security to your accounts by enabling two-factor authentication (2FA). This typically involves receiving a code on your phone or email in addition to your password.

- Monitor Your Accounts Regularly: Frequently check your bank and credit card statements for any unauthorized transactions. Report any suspicious activity immediately.

- Protect Your Personal Information: Be cautious about sharing your personal information online or over the phone. Only provide details to trusted sources.

- Shred Sensitive Documents: Shred documents that contain personal information before disposing of them. This includes bank statements, medical records, and bills.

- Secure Your Devices: Install and update antivirus software on your computer and mobile devices. Use firewalls and keep your operating system up to date.

- Be Wary of Phishing Scams: Do not click on links or download attachments from unknown or suspicious emails and texts. Verify the source before providing any personal information.

- Use Secure Wi-Fi Networks: Avoid using public Wi-Fi for transactions or accessing sensitive information. Use a virtual private network (VPN) if you need to use public Wi-Fi.

- Freeze Your Credit: Consider freezing your credit with the three major credit bureaus (Experian, Equifax, and TransUnion) to prevent new accounts from being opened in your name.

- Review Your Credit Report: Obtain a free copy of your credit report annually from each of the three major credit bureaus and review it for any inaccuracies or unfamiliar accounts.

- Use Secure Websites: Ensure the websites you use for online shopping or banking start with "https" and have a padlock symbol in the address bar.

- Avoid Oversharing on Social Media: Be cautious about sharing personal details on social media platforms, such as your full name, address, or birthdate.

- Be Alert for Mail Theft: Collect your mail promptly and consider using a locked mailbox. Opt for electronic statements when possible.

Methodology

In this study, we aimed to identify the states in the U.S. most vulnerable to identity theft and fraud by analyzing a comprehensive set of data and metrics. The data used for this analysis was sourced from the Federal Trade Commission's (FTC) 2023 Consumer Sentinel Network Data Book, which is the most recent and reliable compilation of consumer complaint data available. The following steps and metrics were employed to conduct this study:

Data Collection

We gathered and utilized the latest available data from the FTC's 2023 Consumer Sentinel Network Data Book. The specific data points included:

- Number of Identity Theft Reports by State: This data provides insights into the frequency of identity theft incidents reported in each state.

- Number of Fraud and Other Reports by State: This metric captures the total number of fraud-related complaints, including various types of fraud beyond identity theft.

- Total Fraud Losses Reported by State: This figure represents the aggregate monetary losses due to fraud reported by residents of each state.

- Median Fraud Losses by State: The median value of fraud losses helps us understand the typical financial impact of fraud incidents in each state.

- Percentage of Reported Financial Losses of All Fraud Reports: This percentage indicates the proportion of fraud reports that involved financial losses.

Metrics and Weighted Scoring

To rank the states from most to least vulnerable to identity theft and fraud, we developed a weighted scoring system based on five key metrics. Each metric was assigned a specific weight, reflecting its relative importance in assessing vulnerability. The metrics and their respective weights are as follows:

- Identity Theft Reports per 100,000 Residents (Weight: 25%): This metric measures the rate of identity theft incidents in relation to the state's population. It provides a normalized view of identity theft prevalence.

- Fraud and Other Reports per 100,000 Residents (Weight: 25%): Similar to the identity theft metric, this measures the overall rate of fraud-related complaints per capita.

- Fraud Losses per 100,000 Residents (Weight: 30%): This metric assesses the financial impact of fraud on a per capita basis, giving more weight to states with higher per capita losses.

- Median Fraud Losses by State (Weight: 10%): The median fraud loss value is used to understand the central tendency of financial impact, with a lower weight due to its nature as a less extreme measure compared to total losses.

- Percentage of Reported Financial Losses of All Fraud Reports (Weight: 10%): This percentage highlights the prevalence of financially impactful fraud incidents, providing additional context to the overall vulnerability.

Scoring and Ranking

Each state was evaluated across these five metrics, and a weighted score out of 100 was calculated for each metric. The state with the highest cumulative score across all metrics was ranked as the most vulnerable, while the state with the lowest cumulative score was ranked as the least vulnerable. This comprehensive approach ensures a balanced and nuanced understanding of the vulnerability landscape regarding identity theft and fraud.

By using these detailed and weighted metrics, our study provides a robust analysis of the states most at risk for identity theft and fraud, helping stakeholders understand and address the underlying issues contributing to these vulnerabilities.